Debt is often secured by specific assets of the firm, while equity is not.Debtholders are guaranteed payments, while equity investors are not.Debtholders are paid before equity investors (absolute priority rule).Equity investors are compensated more generously because equity is riskier than debt, given that: The cost of equity is often higher than the cost of debt.

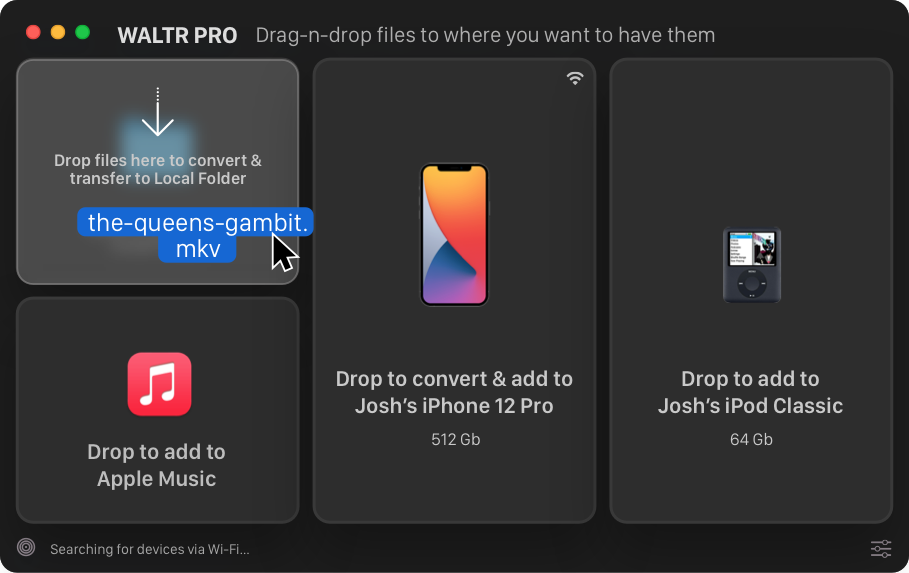

WALTR PRO BETA DOWNLOAD

Download the Free TemplateĮnter your name and email in the form below and download the free template now! It makes sense because investors must be compensated with a higher return for the risk of more volatility (a higher beta). The company with the highest beta sees the highest cost of equity and vice versa. Step 4: Use the CAPM formula to calculate the cost of equity. Step 3: Calculate the ERP (Equity Risk Premium) Step 2: Compute or locate the beta of each company Step 1: Find the RFR (risk-free rate) of the market Cost of Equity Example in Excel (CAPM Approach)

Using historical information, an analyst estimated the dividend growth rate of XYZ Co. is currently being traded at $5 per share and just announced a dividend of $0.50 per share, which will be paid out next year. The average of the growth rates is 2.41%. The growth rate for each year can be found by using the following equation:ĭ t-1 = Dividend payment of year t-1 (one year before year t) Exampleīelow are the dividend amounts paid every year by a company that has been operating for five years. The Dividend Growth Rate can be obtained by calculating the growth (each year) of the company’s past dividends and then taking the average of the values. The share price of a company can be found by searching the ticker or company name on the exchange that the stock is being traded on, or by simply using a credible search engine. If the information cannot be located, an assumption can be made (using historical information to dictate whether the next year’s dividend will be similar). The information can be found in company filings (annual and quarterly reports or through press releases). G = Dividend growth rate Dividends/Share Next YearĬompanies usually announce dividends far in advance of the distribution. The model does not account for investment risk to the extent that CAPM does (since CAPM requires beta). The Dividend Capitalization Model only applies to companies that pay dividends, and it also assumes that the dividends will grow at a constant rate. This value is typically the average return of the market (which the underlying security is a part of) over a specified period of time (five to ten years is an appropriate range). Β i 1: Asset i is more volatile (relative to the market) Expected Market Return Beta can be found online or calculated by using regression: dividing the covariance of the asset and market’s returns by the variance of the market. The measure of systematic risk (the volatility) of the asset relative to the market. The return expected from a risk-free investment (if computing the expected return for a US company, the 10-year Treasury note could be used). The model is less exact due to the estimates made in the calculation (because it uses historical information).Į(R m) = Expected market return Risk-Free Rate of Return CAPM (Capital Asset Pricing Model)ĬAPM takes into account the riskiness of an investment relative to the market. The cost of equity can be calculated by using the CAPM (Capital Asset Pricing Model) or Dividend Capitalization Model (for companies that pay out dividends).

Companies typically use a combination of equity and debt financing, with equity capital being more expensive. A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities. Cost of Equity is the rate of return a company pays out to equity investors.

0 kommentar(er)

0 kommentar(er)